This article is part of a series being shared to highlight activist struggles across Europe and grassroots response to health and economic crisis. These articles are shared in preparation for the event ‘Reclaiming the commons: From austerity and debt to public space and health as commons’ which will take place next Wed 27th Jan.

Author: Fanny Malinen @fannymalinen

As one of the first austerity measures the right-wing UK government announced when they got into power over ten years ago was to treble tuition fees for university students. I was a student at the time, and the wave of protests and university occupations was a generation-defining experience. But we did not succeed in overturning the decision, and now students in the UK graduate with an average of over £50,000 of student debt.

As one of the first austerity measures the right-wing UK government announced when they got into power over ten years ago was to treble tuition fees for university students. I was a student at the time, and the wave of protests and university occupations was a generation-defining experience. But we did not succeed in overturning the decision, and now students in the UK graduate with an average of over £50,000 of student debt.

Students who started only two years after me and received the exact same education had to get three times as much into debt. I saw how this changed their relationship to their education: suddenly it became less about knowledge and critical thinking, and more about landing a good job to pay off that debt. It made me realise that that debt was a socially constructed discipline mechanism.

Since then, I have been working on debt in one way or another.

The debt discipline that I had seen in action in my fellow students’ lives extends also to public authorities. Debt brings with it a pressure to play by the rules of the system – often the financial system. We have seen this in countries of the global South in the 1980s; in the Eurozone periphery countries in the early 2010s; and in local councils across the UK today. Debt repayments are prioritised over everything else, even if it literally costs lives, because the alternative would be to lose access to the funding that is only available through market logic.

In 2011, the Occupy movement took on the financial sector in a way not quite seen before. When the camps were dispersed, a few of us set up a group called Debt Resistance UK to continue working on topics of debt and finance. In the US, an Occupy offshoot Strike Debt focused on personal debt, such as student debt and healthcare debt. In the European countries that had been hit hard by bank bailouts, the mobilisations took the form of a citizen debt audit: people who had met on the squares during 15M got together to scrutinise public debts and argue that some of them were illegitimate and should not be paid.

The political context in the UK shared both the issue of private debt and that of bailout-induced austerity. But contrary to the US, in the UK student loans are effectively a form of an extra tax and need to be paid back much later. Problem debt in the UK had the face of families struggling to pay rent and eat. It was consumer debt: credit cards, rent-to-own, payday loans taken out by a whole range of people without much of a common denominator. Austerity was different, too, as it wasn’t imposed by international financial institutions but rather a government that controlled the public narrative.

Citizen debt audit of UK local authorities

In the end, we almost stumbled upon a local authority debt audit. The project started in 2013 when friends from an organisation called Move Your Money discovered that many local authorities across the UK had taken out loans from banks instead of borrowing from the central government. The loans were complex and long term, called LOBO for lender option borrower option.

In the end, we almost stumbled upon a local authority debt audit. The project started in 2013 when friends from an organisation called Move Your Money discovered that many local authorities across the UK had taken out loans from banks instead of borrowing from the central government. The loans were complex and long term, called LOBO for lender option borrower option.

Together with Move Your Money, Debt Resistance UK used the Freedom of Information Act to uncover the extent of councils’ LOBO borrowing. Based on this, Debt Resistance UK was able to compile a public database of LOBO loans (now out of date) and provide information to journalists. Working with councillors was also of key importance, although UK local authorities are very centralised and we discovered that elected representatives often had no more access to information than any resident. We also used campaigning tools like submissions to inquiries, open letters and shareholder activism, and engaged local residents and communities. Working with communities and popularising the issue of debt is at the heart of a citizen debt audit – but it can be difficult, because a key part of the power of finance is its obscure complexity.

LOBO loans start with a fixed or variable interest rate. The lender has the option to propose a new rate at predetermined call periods, which can be from six months to five years. The borrower’s option is to either accept the new rate or repay the loan in full. If the bank does not exercise its option, the council can only exit the loan early by paying an exit fee, which is entirely at the discretion of the bank and usually very high. At least 240 councils were sold LOBO loans by several UK and European banks. The first LOBO loans were sold in the 1980s, but there was a marked increase in LOBO borrowing in the early 2000s in the run-up to the financial crisis.

In 2017, three of us who had been involved in Debt Resistance UK started a worker co-operative called Research for Action and secured funding for continuing the work in the most indebted council in the country, East London’s Newham. In October 2018, we published a report detailing why Newham’s LOBO debt was illegitimate.

Winning on LOBO loans

While we had been working on the report on Newham’s LOBO debt, the council had changed leadership. The new Mayor Rokhsana Fiaz had previously been a backbench councillor and one of the few critical of LOBO loans. Soon after she took office, the council announced legal action against Barclays bank. A year after she became Mayor, Fiaz announced Newham Council had agreed with the Royal Bank of Scotland to terminate LOBO loans to the bank early and with considerably low breakage fees. The council repaid the debt by borrowing from the central government with lower interest rates: according to the council, the renegotiation would save them £3.5m per year. As the loans would have run for another 41 years, savings totalled £143m. Through Freedom of Information requests we found out that RBS had made similar deals with councils across the country.

While we had been working on the report on Newham’s LOBO debt, the council had changed leadership. The new Mayor Rokhsana Fiaz had previously been a backbench councillor and one of the few critical of LOBO loans. Soon after she took office, the council announced legal action against Barclays bank. A year after she became Mayor, Fiaz announced Newham Council had agreed with the Royal Bank of Scotland to terminate LOBO loans to the bank early and with considerably low breakage fees. The council repaid the debt by borrowing from the central government with lower interest rates: according to the council, the renegotiation would save them £3.5m per year. As the loans would have run for another 41 years, savings totalled £143m. Through Freedom of Information requests we found out that RBS had made similar deals with councils across the country.

In early 2019, seven councils announced they were suing Barclays. The bank had sold them LOBOs with interest rates pegged to LIBOR, a benchmark rate set by a group of London banks, including Barclays – and which, as it emerged in 2012, the banks had been manipulating. The case is still ongoing.

The importance of collective action

The Platform for a Citizens Debt Audit (PACD) in the Spanish state has been an important inspiration for our work. But the idea of debt audits has a history that goes back to the 1980s debt crisis that ravaged the global South. The only official debt audit on a state level ever conducted was in Ecuador in 2008. In Greece, the Speaker of Parliament created a debt audit committee which published an interim report in 2015 declaring much of the country’s debt to international creditors odious, illegal and illegitimate, but it was soon followed by a change of government and no action was taken. These audits are expert-led and hence different from citizen audits, although both were preceded by grassroots mobilisations.

The PACD defines a citizen debt audit as “a process to, collectively, understand how we have arrived at the current situation; what economic, social, cultural, environmental, gender and political impacts has this indebtedness created.”

This collective understanding will inform what debt is illegitimate and should not be repaid.

An important part of Debt Resistance UK and Research for Action’s work on LOBO loans was to support residents to take action locally. According to the Local Audit and Accountability Act, residents in UK local authorities have the right to object to spending they believe might be illegal or not in the public interest. The objections were useful for spreading awareness and accessing more information, however they did not lead to the councils’ auditors – who are private companies – examining the loans. The objections were also a time-consuming process and people found they were not taken seriously by the audit companies.

In Newham, we wanted to extend working with the local community. Newham is also one of the most deprived areas in the country, and we found it important to connect with those adversely affected by the payment of illegitimate LOBO debt.

We had a good relationship with housing campaigners in the area, Focus E15 campaign. We also approached different groups who did community work in areas affected by cuts, interviewing people for evidence-gathering and then running a workshop on council finances in return for their time.

These exchanges were very valuable for everyone involved. However, although many people and groups were happy to speak to us about austerity, lack of services and the mismanagement of the council, it turned out to be more difficult to engage people on the issue of finance. The council’s complex financial arrangements were a remote subject that many people felt they could not really relate to, even if they were interested to hear about them. They were angry and struggling – although the millions of pounds flowing from the council to private banks gave ammunition to campaigners such as Focus E15 who were confronting the council for making them homeless.

How debt gets passed down through austerity

Debt disciplines the indebted to act in the interests of the creditor who has the power to enforce repayments. It drains resources from other spending: for local authorities, that is vital services such as housing, education, social care, youth work and many more. This in turn leads to indebtedness being passed down to those who suffer most from austerity: when people get poorer, they need to rely on borrowing just to make ends meet. Already before the pandemic, a fifth of the UK population was in poverty. In some areas of East London, 4 out of 10 children were poor. The Covid crisis is set to push millions more into poverty.

Debt disciplines the indebted to act in the interests of the creditor who has the power to enforce repayments. It drains resources from other spending: for local authorities, that is vital services such as housing, education, social care, youth work and many more. This in turn leads to indebtedness being passed down to those who suffer most from austerity: when people get poorer, they need to rely on borrowing just to make ends meet. Already before the pandemic, a fifth of the UK population was in poverty. In some areas of East London, 4 out of 10 children were poor. The Covid crisis is set to push millions more into poverty.

One of the great injustices of debt is that those who most need credit get it at the worst terms. The less one’s income and assets, the fewer options they have and the higher the cost of credit becomes as people are seen as less creditworthy by market logic. Between years 2017 and 2019, Research for Action was part of a coalition of organisations campaigning for a cap on the cost on all forms of consumer credit. In practice, this would mean that for every £1 borrowed no one would need to pay back more than £1 in interest and fees. A similar cap has been in place on payday loans since 2015 and was recently extended to rent-to-own products.

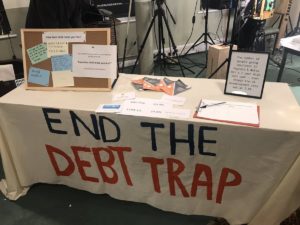

As part of the campaign – called End the Debt Trap – I worked with a community organiser to bring together a group of people who were experiencing debt or worried about debt in their communities. The Unfair Debt Group was born.

Building collective power to take on unfair debt

Campaigning on debt is a lot about the underlying causes of poverty. It brings together many issues from inadequate benefits to precarious work and housing. This makes it a great focal point to bring together people from all walks of life – but it also makes organising difficult.

With the Unfair Debt Group, we started with a long list of demands: firstly, no one should have to pay extortionate amounts for their debt; secondly, no one should be treated unfairly when they have to get into debt; thirdly, no one should have to get into debt just to survive. The details of these demands range from a cost cap on all borrowing to better access to debt advice, an end for councils’ bailiff use for collecting debts, and a fairer benefit system.

The group is small, but we have had successes, most recently a meeting with debt collectors Lowell which resulted in Lowell agreeing not to pursue over £5,000 worth of one of the members’ debts. Before the pandemic, we had regular meetings with the Deputy Mayor of the London borough where most of the members are based, Tower Hamlets. The End the Debt Trap campaign also created an opportunity for the Unfair Debt Group to go and meet MPs in Parliament. Members have been able to tell their stories to those in power and feel listened to.

The group is small, but we have had successes, most recently a meeting with debt collectors Lowell which resulted in Lowell agreeing not to pursue over £5,000 worth of one of the members’ debts. Before the pandemic, we had regular meetings with the Deputy Mayor of the London borough where most of the members are based, Tower Hamlets. The End the Debt Trap campaign also created an opportunity for the Unfair Debt Group to go and meet MPs in Parliament. Members have been able to tell their stories to those in power and feel listened to.

For most members, the highlight has still been organising events and reaching out to other people to reduce the stigma associated with debt. Before the pandemic, we had regular street stalls where we talked to people about debt, collecting their debt stories and inviting them to meetings. These encounters made us better understand what the issues with debt were in our communities, and provided a space for passersby to talk about issues they had maybe never opened up to anyone about. One of the last things we did when it was still possible to sit in a room with other people was a Debt Story Cafe that enabled this sharing of stories in a more structured way over food and drink and discuss how to build power to change the system.

When we started the Unfair Debt Group, I and others expected that it would be difficult to get people to take on the identity of someone in debt as there is such a great stigma attached to it. Debt is also a very individualising issue. However, this has not been a problem to the extent that we expected – people who live in poverty often rely on their family networks and communities to get by. It is a constant navigation of a terrain where financial difficulty is now so widespread that debt is simply a fact of life. The stigma is of course there, but so it is for organising on poverty or mental health.

In the end the greatest barrier to organising has been the same as with any other issue: time. People who have debt problems are poor, in precarious work or housing, disabled, or have families. The pandemic is only increasing these issues, and in addition it has now been unsafe to hold meetings in person for nearly a year.

The economic crisis that the pandemic has created also makes organising on debt more important than ever: in the UK, the government’s shambolic response has exposed the contempt it has towards the people. It underscores the need for solidarity, mutual support and people power.

Beyond economic inequality, debt also reproduces oppressions: austerity measures affect women, communities of colour, disabled people and sexual and gender minorities disproportionately. This is why organising on debt has to be an effort that goes beyond the financial. We need to contest the power that comes with providing credit and build our power to change the oppressive and exploitative structures.

Ultimately, tackling debt is about a democratic management of resources for the public good: decent funding for vital services and an economic system where people are not exploited for profit.

Leave a Reply